Table of Content

However, they do not represent a financing proposal or a financing confirmation. For us to find the optimal mortgage for you, we need to know your personal financial situation. Banks in Germany like safety and are interested in you paying back the mortgage. That is why banks in Germany are so strict about approving a mortgage.

The more equity or savings you bring in, the lower your loan-to-value ratio LTV and hence the interest rate at which the bank grants you your mortgage. Typically, banks lower the interest rate gradually in 5% steps of the LTV. In other words, a higher down payment means a lower LTV and a lower interest rate, and vice versa, a lower down payment means a higher interest rate due to a higher LTV.

LIC HOUSING FINANCE Home Loans FAQs

Although our personal/financial situation was less than ideal, Başar was able to secure us an extremely favourable loan. I really doubt another broker could have done as well." Your personal mortgage expert will support you to review and understand all your options. Together with our team of experienced brokers, you will understand the nuances of your situation and fine-tune your mortgage decision. Our engine combines modern finance theory with practical insights from our team of mortgage brokers. Calculate whether you'll have enough income in retirement to maintain your lifestyle in Germany.

Check the details of the registration form and sign it. Click on Print/Save form and print the registration form. All the eligible policy numbers enrolled will be displayed at this stage.

Home Loan Eligibility

Your home loan eligibility is partially dependent on your CIBIL score. LIC HFL will assess your risk profile before finalising on the final interest rate. For instance, salaried professionals with a CIBIL score of 700 and above can avail a home loan at 6.90% p.a. Similarly, a salaried professional with a CIBIL score of less than 600 can get a loan at 7.80% p.a., which is far higher than the rate offered to an individual with a good credit score. So, do enjoy best rates, try to maintain a good CIBIL score.

They have sanctioned the loan within 15 days. But they have disbursed the amount in installment. Pre closure charge is applicable at any time. There are some charge for enclosure and stamping are around of 2K. Both LIC HFL and HDFC Ltd offer a variety of home loan schemes at attractive rate of interest.

LIC Housing Home Loan Reviews

All families having income of Rs 3 lakh to Rs 18 lakh are eligible under this scheme. For list of statutory towns eligible under the scheme visit the official website of National Housing Bank. Login to the customer portal with ID & password. Select 'Home loan provisional certificate' option under Enquires. Enter your home loan details and proceed for LIC home loan statement. Now you can view, print or download LIC home loan statement.

Employee named piyali das posted at chowringhee sq branch was involved with the branch manager. They ensured the delay of my loan transfer on arious pretexts. The rae of interest never falls once youbtake loan. I have taken home loan directly through LIC Housing Finance Ltd. How can I change the interest rate for LICHFL home loan? You can change the interest rate for the home loan availed from LICHFL by logging into the customer portal.

LICHFL Home Loan Interest Rate December 2022

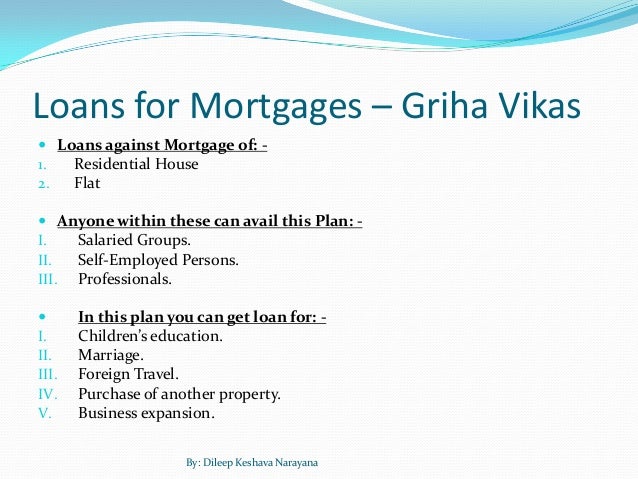

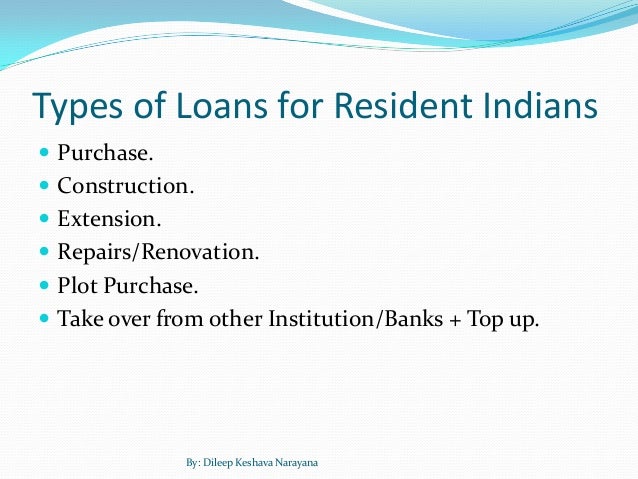

Loans are available for purchase of residential plots for construction of house within period of 3 years. Yes, LIC offers loans to partnership firms and companies subject to specific terms and conditions. These entities can avail loan against property in the name of the firms for business purposes.

Under certain conditions, it is also possible to finance a property without equity. These include, for example, a very good credit rating, a very high income, and an excellent location of the property. However, the bank will charge significantly higher interest. To optimize the recommendation engine, we review daily the mortgage products and conditions of over 750 lenders. We then model and estimate their hidden conditions.

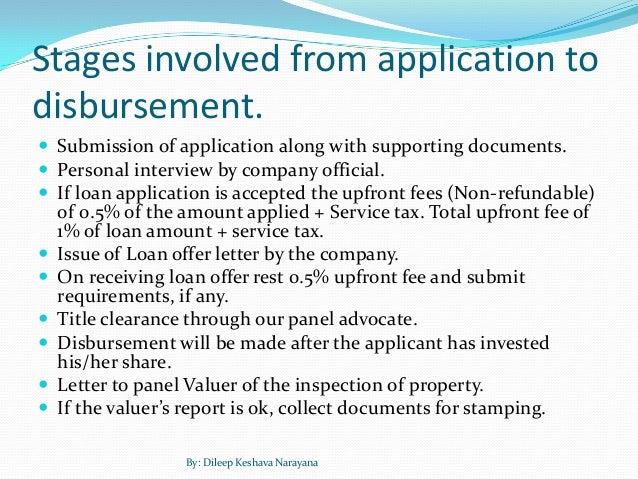

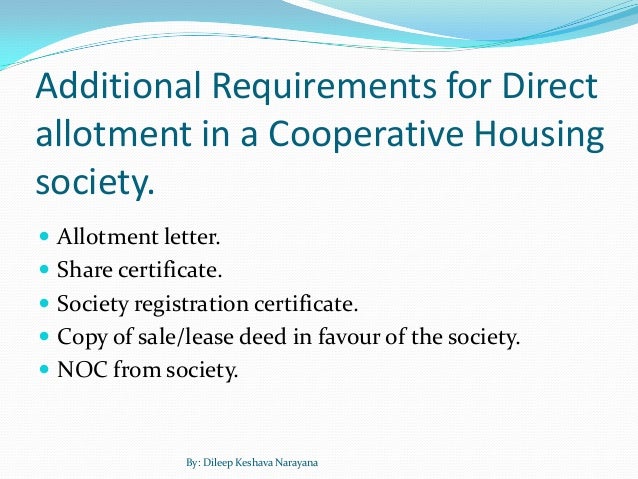

No third party payment should be made using this mode of payment. An applicant needs to submit the following documents while applying for the home loan scheme. Mortgage lendersto reduce time and optimise the mortgage loan experience. The results of the German mortgage calculator are realistic sample calculations.

You are different from the average customer, sometimes a little and sometimes a lot. Refinance your existing home in Germany to lower interest rates or cash out on your home equity. The waiting times for this flight have not yet been determined or are not available. Please try again later or refer to the information boards at the airport. After verification by our offices, an acknowledgement e-mail and SMS will be sent to you. Print the form, sign it and upload the scanned image of the form.

Bank statements for last 6 to12 months (For self-employed and professionals). The applicant must have a steady and regular “verifiable” source of income. Last 1 year's LIC loan account statement along with sanction letter . The borrowers should be 50 years old or more. They should have a pension scheme post retirement. 75% of the property’s total cost for LIC Housing Finance Home Loan above Rs. 75 Lakhs.

The monthly repayment rate comes from the loan amount, the annual interest rate, and the annual repayment rate. The interest rate is fixed for a certain term. Particularly long fixed interest rates are usually higher. You can pay your EMIs online by logging in to your account on the LIC HFL website in the customer portal.

However, German banks have different guidelines when it comes to rating the creditworthiness of applicants for a mortgage. For us to find the best mortgage for you, we need more information about you, your financial situation, and your future plans. With this information, our financing experts can explain your possible options in detail and provide a free personalized mortgage recommendation. After entering this data into the German mortgage calculator, we calculate the estimated loan amount, interest rate, and monthly repayment rate.

For example, it is advisable to plan the mortgage, so you have paid it off by the time you retire. Also, keep in mind that you usually need to pay the additional purchase costs yourself. However, it is possible to take out a separate personal loan for this purpose. Furthermore, your monthly repayment should be calculated realistically, so you can easily cover it without having to restrict your accustomed standard of living. Repayment period Regardless of the interest rate, the faster you repay your mortgage, the lower your financing costs will be, as you will only pay interest on the remaining loan amount. Vice versa, the slower you repay your loan, the higher your financing costs will be.